Firms normally should comply with typically accepted accounting ideas issued by the Monetary Accounting Standards Board when recording depreciation. So, if a machine helps make merchandise for 5 years, its cost should be unfold across those 5 years rather than hitting the books all at once. In this technique the manufacturing or preliminary costs of an asset are evenly unfold in the course of the course of its useful life span. This value is then divided by the number of straight line depreciation formula calculator years it’s anticipated to be used and the worth obtained is additional subtracted from the second 12 months on. Enter the entire value to acquire the asset, or the adjusted foundation, whichever is the lesser quantity (without dollar sign or any commas).

It allocates an equal quantity of an asset’s cost to each yr of its helpful life, offering a consistent and predictable expense pattern. It’s not advisable to make use of this methodology if there’s no significant difference within the usage of belongings from one interval to another. This might lead to you having to spend too much time preserving observe of the asset’s utilization. Nevertheless, you’ll solely get outcomes which have very slight variations compared to if you used the straight line depreciation technique. Next, you divide the asset’s depreciable base by the variety of years you count on the asset to last.

🛠️ Options Of The Straight-line Depreciation Calculator

This calculator provides instant and precise results, saving priceless time. Nevertheless, it reduces taxable income, which not directly improves cash circulate by reducing taxes owed. Double Entry Bookkeeping is right here to offer you free on-line data that will assist you learn and understand bookkeeping and introductory accounting. Straight-Line Depreciation is the uniform reduction within the carrying value of a non-current fastened https://www.kelleysbookkeeping.com/ asset in equal installments throughout its useful life. Let’s learn how the straight-line depreciation technique calculator can profit you.

Conversion Calculators

Calculate depreciation bills using the straight-line methodology, the most common depreciation methodology for accounting and tax functions. This methodology spreads the value of an asset evenly over its helpful life, making it easy to calculate and perceive. Nonetheless, tax rules differ by country, and a few tax authorities might favor accelerated depreciation strategies, such because the double-declining steadiness methodology, for sure forms of belongings. It is important to consult with a tax skilled to make sure compliance with local tax legal guidelines. Depreciation is a vital concept in both accounting and monetary management. It helps companies allocate the price of tangible property throughout their helpful life, making certain that financial statements accurately reflect asset usage and wear over time.

Coming Soon: Learn About Essential Information

By utilizing a calculator, you ensure accuracy, save time, and help higher planning and compliance with accounting standards. The Straight Line Depreciation Calculator is an important software for accountants, business owners, and financial managers who need to unfold out asset costs evenly over time. It simplifies the method by offering constant results, eliminating handbook calculation errors, and generating clear schedules for monetary reporting. Straight-line depreciation is a simple and extensively accepted methodology to account for asset depreciation. With just three inputs—initial cost, salvage value, and helpful life—you can calculate how much worth an asset loses annually. Use our Straight Line Depreciation Calculator to save heaps of time and make informed decisions for your private or business finances.

The straight-line foundation is also an appropriate calculation method because it renders fewer errors over the life of the asset. These eight depreciation methods are mentioned in two sections, each with an accompanying video. The first part explains straight-line, sum-of-years’ digits, declining-balance, and double-declining-balance depreciation. Whereas it’s the best methodology, different strategies like declining steadiness depreciation may be extra suitable for belongings that lose value quickly. Whether Or Not you’re an accountant, business owner, or investor, this calculator simplifies your calculations and ensures correct financial reporting. Depreciation plays a pivotal role in accurately representing an organization’s monetary efficiency and tax liabilities.

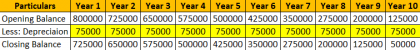

Since this calculator has been examined to work with many setup and entry combos, I probably won’t be ready to find and repair the issue with out understanding your set-up and the information you entered into the calculator. If you would like a depreciation schedule included within the results so you presumably can print it out, transfer the slider to the “Yes” position. Or, if you need calculate or learn about the Modified Accelerated Value Recovery System (MACRS) method, please go to the MACRS Calculator. Sure, so long as you know the preliminary price, salvage worth, and expected years of use.

Let’s take an asset which is worth 10,000 and depreciations from 10,000 all the finest way to 2,000 in the time span of 5 years. A enterprise buys workplace furnishings for $15,000, expects to use it for 10 years, and estimates a salvage worth of $1,000. If the instruments panel becomes “Unstuck” by itself, attempt clicking “Unstick” and then “Stick” to re-stick the panel. Select Present or Hide to show or disguise the popup keypad icons located subsequent to numeric entry fields. These are usually only wanted for mobile gadgets that do not have decimal points of their numeric keypads.

You expect to make use of it for 10 years, and its salvage worth on the finish of that period is $500. 1 introduces important tax reforms that CPAs must be ready to navigate. These legislative adjustments represent some of the most complete tax updates in latest times, affecting both particular person and corporate taxpayers. The IRS publishes schedules giving the variety of years over which several types of assets can be depreciated for tax purposes.

- If you want to a depreciation schedule included within the results so you’ll have the ability to print it out, move the slider to the “Yes” place.

- Whether you’re an accountant, business owner, or investor, this calculator simplifies your calculations and ensures correct monetary reporting.

- Straight-line depreciation is a method of allocating the price of a tangible mounted asset evenly over its helpful life.

- He has labored as an accountant and advisor for greater than 25 years and has constructed monetary models for every type of industries.

You can calculate straight-line depreciation of the given asset with this little gizmo in real-time. Our straight-line depreciation calculator is among the most useful tools out there for what it does. Straight-line calculation is actually pretty easy given that the depreciation fee is fixed over a time period, thus, the name, the straight-line methodology. The straight line depreciation methodology may be very useful in recognizing and evenly carrying the amount of a hard and fast asset over its useful life. You use it when there’s no specific pattern to how you’ll use an asset over a period of time. As aforementioned, that is the best depreciation technique because it ends in only a few errors in calculation.